Age

Salaried Individuals: The minimum age is 21. Government employees can apply until 70, others until 62.Self-Employed: The minimum age required is 21 years, maximum age is 70 years.

Loan Tenure

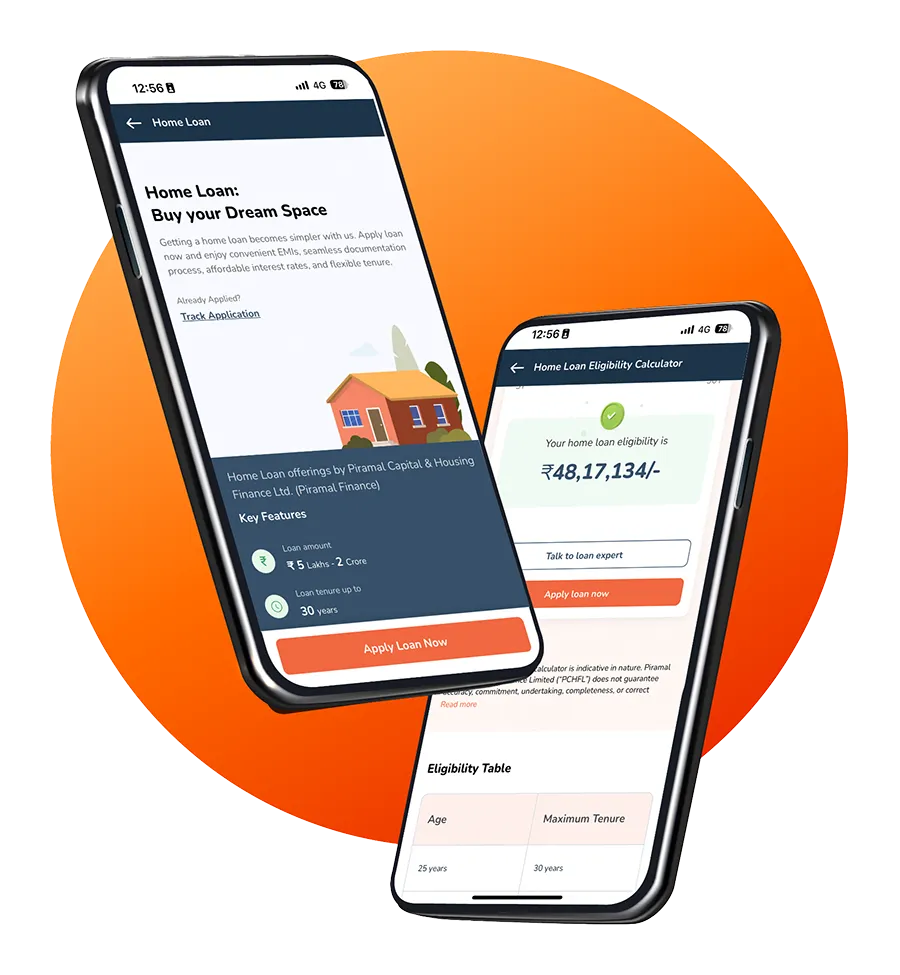

Up to 30 YearsEmployment status

Applicants working in public and private sector companies as well as self-employed individuals are considered eligible for a home loan.Credit Score

We at Piramal Finance offer home loan to applicants with Credit Score of 750 and more.

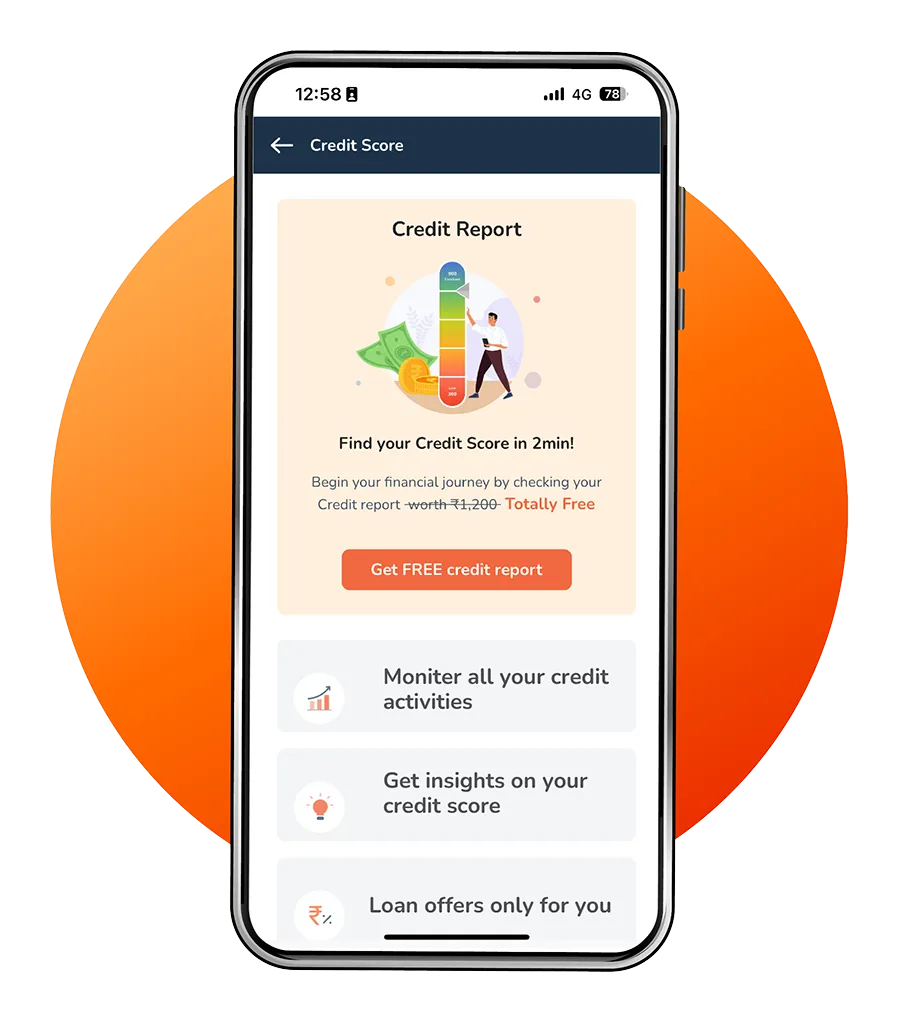

Check Credit Score for Free

Piramal Finance offers a free credit report, providing all the necessary insights and details in a click.

Plan your loan EMI and check loan amount eligibility

Simply click on the 'Download for Android' or 'Download for iOS' buttons located on the top banner, and you'll easily download the app via the Play Store or the App Store from your mobile device.

Yes, the Piramal Finance mobile app is completely free to download and use.

You can apply for a home loan through the app. Once the application is completed, visit any of our nearby branch to get the loan.

You can keep track of your loan application status effortlessly through our mobile app.

A credit score of above 750 is regarded as a good score to avail a home loan. You can always improve a low credit score, as a good score will increase your chances of getting an easy loan from Piramal Finance.

Credit Clean-up: You can improve your eligibility by increasing your credit score. A higher credit score makes you a reliable borrower.

Rebalancing your income and debts: Your income-to-debt ratio helps determine the portion of your income that gets contributed towards covering your debts. A low income-to-credit ratio can make you eligible for a home loan.

You can make the payment using E-Nach (National Automated Clearing House). It is the most convenient & secure method of making payment.

A name you can trust

Parentage of

40+ years

More than

26 Lac+ Customers

Presence in

425+ Locations

More than

5K+ Partner Outlets