A credit report is a detailed summary of someone's financial history, focusing on borrowing and repaying money. Credit bureaus or reporting agencies compile it and include information such as:

Name, address, social security number (for individuals), and other identifiers.

Details about loans, credit cards, and lines of credit, including payment history and status.

Records of timely payments, late payments, defaults, or missed payments.

Information from public sources, like bankruptcies, tax liens, or court judgments.

A list of inquiries that affect overall credit score.

Ratio of credit used to the total available credit.

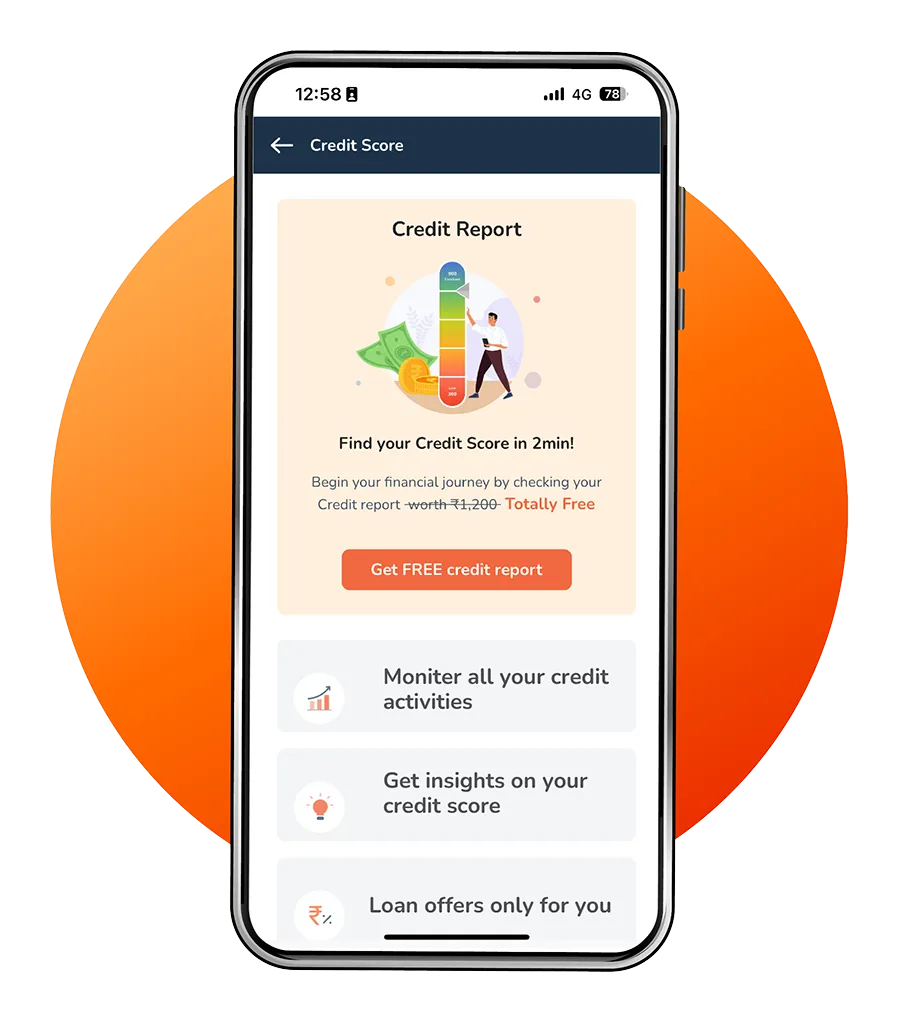

Credit reports help lenders, creditors, and employers assess creditworthiness, impacting loans, credit terms, interest rates, and jobs. Regular reviews detect errors, ensure accuracy, and guard against fraud.

Simply click on the 'Download for Android' or 'Download for iOS' buttons located on the top banner, and you'll easily download the app via the Play Store or the App Store from your mobile device.

Yes, the Piramal Finance mobile app is completely free to download and use.

You can conveniently get a detailed credit report directly through the app.

A credit score of above 750 is regarded as a good score to avail a loan. You can always improve a low credit score, as a good score will increase your chances of getting an easy loan from Piramal Finance.

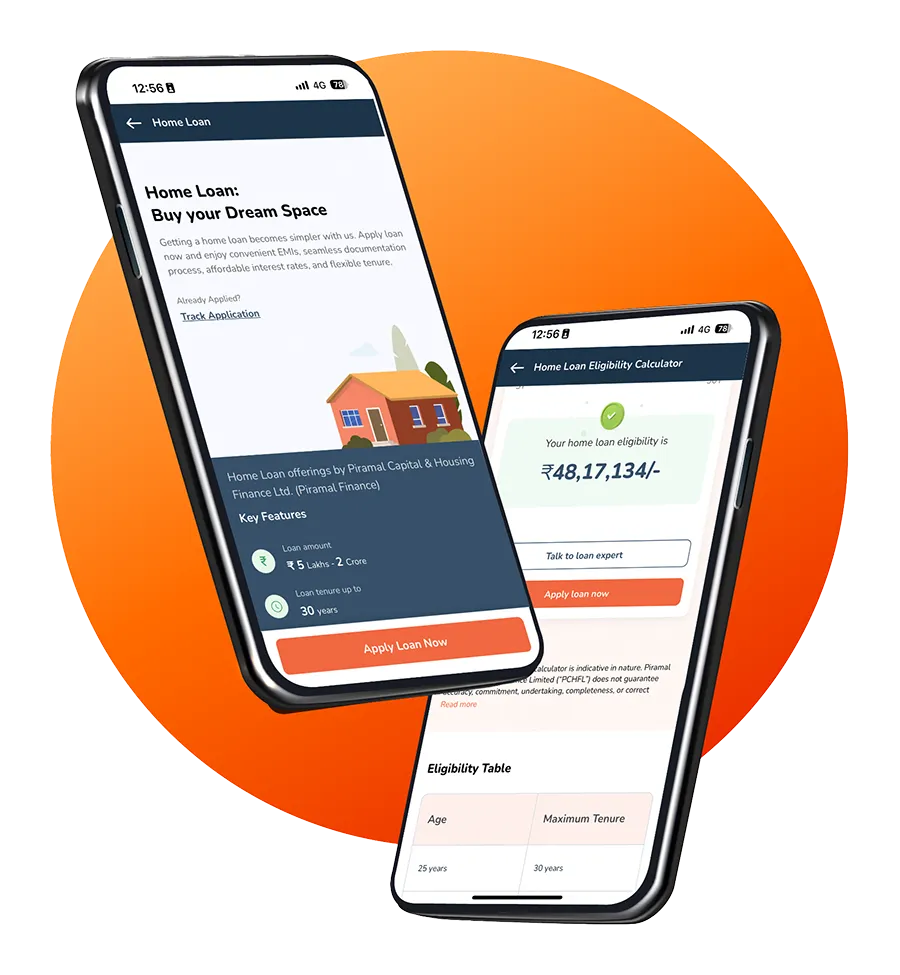

Credit Clean-up: You can improve your eligibility by increasing your credit score. A higher credit score makes you a reliable borrower.

Rebalancing your income and debts: Your income-to-debt ratio helps determine the portion of your income that gets contributed towards covering your debts. A low income-to-credit ratio can make you eligible for a personal loan.

A name you can trust

Parentage of

40+ years

More than

26 Lac+ Customers

Presence in

425+ Locations

More than

5K+ Partner Outlets